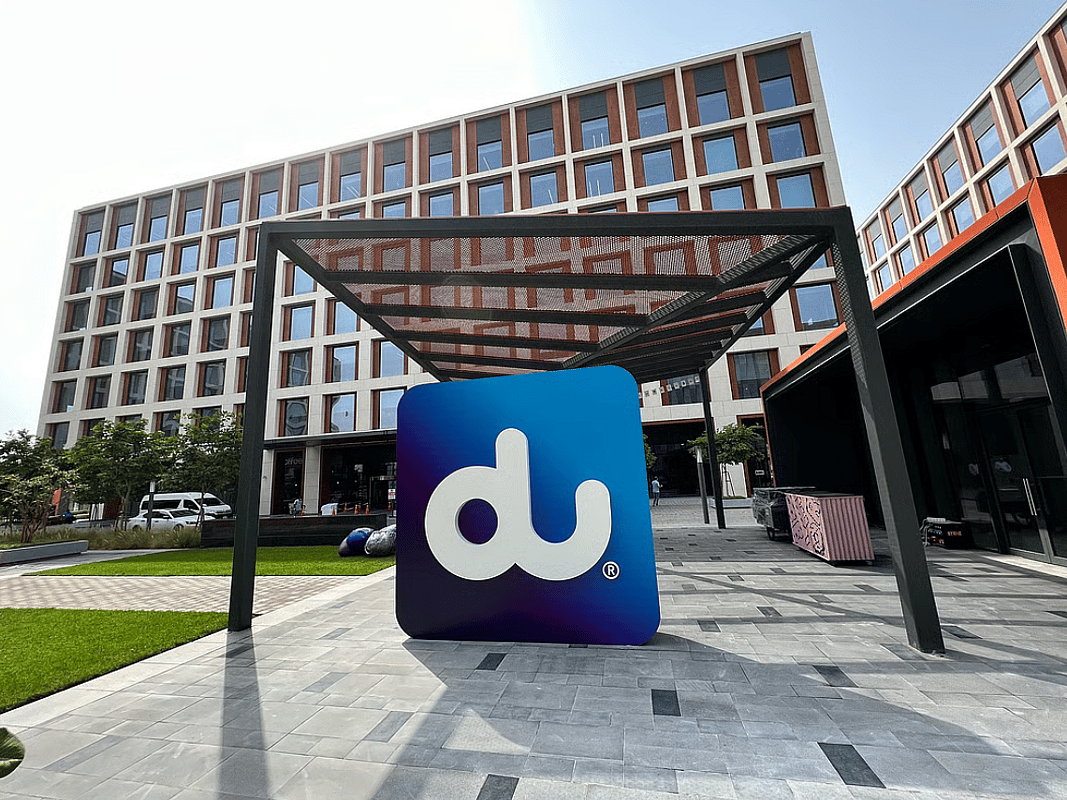

UAE Telecom Giant du Announces Sale of 342 Million Shares

Offering expected to raise up to Dh3.39 billion as Mamoura Diversified reduces stake; retail and institutional investors invited to subscribe

by Allen Cot

Offering could raise up to Dh3.39 billion as Mamoura Diversified trims stake; retail and institutional investors invited to participate

Emirates Integrated Telecommunications Company (du), the UAE’s second-largest telecom operator, has announced the launch of a major share sale involving 342,084,084 shares listed on the Dubai Financial Market (DFM). The nominal value of each share is Dh1, representing 7.5467 per cent of the company’s total issued shares.

The shares have been offered for sale by Mamoura Diversified Global Holding (formerly Mubadala Development Company PJSC), which previously held a 10.0622 per cent stake in du. Following the offering, its ownership could shrink to 2.5156 per cent, depending on full subscription.

Price Range and Proceeds

The company has set a price range of Dh9 to Dh9.90 per share, with the sale expected to raise between Dh3.078 billion and Dh3.386 billion. Du’s stock closed at Dh9.90 on Friday, down 0.3 per cent. The company noted that it reserves the right to amend the offering size before the end of the subscription period, subject to approval by the Securities and Commodities Authority (SCA).

Shareholding Structure

Du’s current shareholding is led by the Emirates Investment Authority (EIA), which owns 50.1164 per cent, followed by DH 8 LLC at 19.6657 per cent, and Mamoura Diversified Global Holding with 10.0622 per cent. The remainder is held by public shareholders, both UAE nationals and international investors.

Subscription Details

The subscription window for the share sale opened on September 8, 2025, and will close on September 12, 2025. The offering has been divided into two tranches:

- Tranche One (Retail Investors):

- 5 per cent of the shares, or 17.104 million shares, allocated.

- Guaranteed minimum allocation of 500 shares per subscriber, subject to limits in the prospectus.

- Minimum subscription size is Dh5,000, with increments of Dh1,000.

- No maximum application size.

- Tranche Two (Institutional Investors):

- 95 per cent of the shares, or 324.979 million shares, allocated.

- Minimum subscription size is Dh5 million.

Additionally, a five per cent share sale offer will be extended to the Emirates Investment Authority (EIA).

Banking Partners

Emirates NBD has been appointed as the lead receiving bank, while Abu Dhabi Commercial Bank (ADCB), Emirates NBD Capital, and First Abu Dhabi Bank (FAB) are serving as joint lead managers. Investors can subscribe via bank branches, ATMs, and electronic platforms of DFM, Emirates NBD, ADCB, ADIB, DIB, FAB, Mbank, and Wio.

Financial Performance

The share sale comes amid strong financial momentum for du. The telecom operator reported a net profit of Dh921 million for the first half of 2025, a 15 per cent increase from Dh801 million in the same period last year.

The move signals a significant reshaping of du’s shareholder base and underscores growing investor interest in UAE-listed telecom firms as the sector continues to expand alongside the country’s digital economy.

Post Views: 703